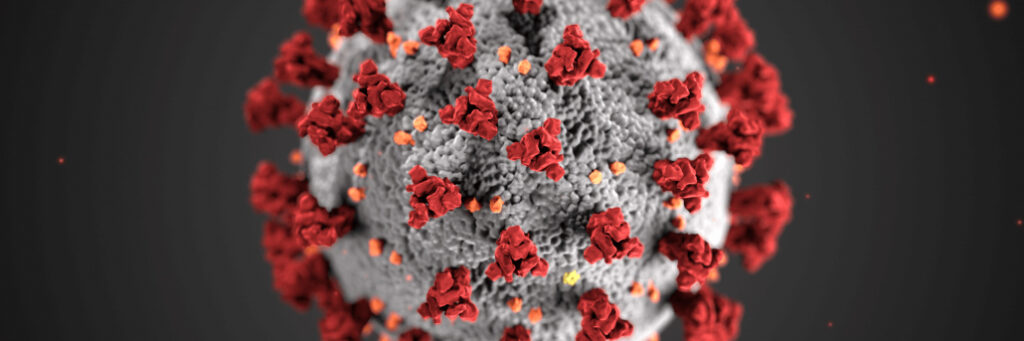

The Coronavirus (COVID-19) spreading around the world presents an incredible scenario as it impacts every aspect of our lives. The global economy is feeling the disruption as share markets operate with a high level of volatility.

Safe as houses?

One of the interesting phenomena that often occurs during a time of global crisis is that people will lean toward more traditional and perceived secure investments. As they attempt to reduce their risk in a time of uncertainty, they often move to what they consider as safer physical assets such as property.

Despite what’s happening internationally with the Coronavirus, the majority of local property markets continue to remain relatively stable.

The Federal Government has acted announcing a range of stimulus packages as it prepares to support the economy during the coming months.

Interests rates are at an all-time low

Earlier this month, we saw the Reserve Bank of Australia decrease the cash rate to 0.50% in a move to support the economy in direct response to the global Coronavirus outbreak. There is also a strong indication that the Reserve Bank will cut rates even further when they meet in April.

Market forecast

At this stage no one knows how we will be affected in Australia in the short term nor how long those effects will last. However with interest rates at all-time lows, the real estate market continues to look very positive and a safe haven for many. The underlying fundamentals supporting the Australian property market in general have not changed (remembering there are multiple markets, and markets within markets).

If you are want to talk in more detail about your personal position and making the best sense for your strategy, email [email protected] or call 1300 897 000 to make an online meeting at a day and a time that suits you.